Funny Korean Boss Gets Nervous When Secretary Flirts

UK housebuilder Berkeley has called the top of the London housing market.

After some bumper years, Berkeley told shareholders that profits will drop by 30% in the 2018/19 financial year, as the sector returns to "more normal" times.

Chairman Tony Pidgley says that new housing starts in London have dropped by a third in the last two years (or since the EU referendum, basically).

Pidgley blames Brexit uncertainty for the drop in activity:

It is telling that some funders and builders are choosing to exit the market when faced with the degree of risk and regulation that now confronts development in the capital where macro and political uncertainty, including Brexit, are leading to this caution.

This is a great shame as London is a fantastic world-class city with unique attributes that will last long beyond the current hiatus which is only exacerbating the well documented under-supply.

Stocks are recovering because investors are snaffling up bargains after Tuesday's rout, says Ken Odeluga of City Index.

He believes the People Bank of China's intervention overnight is reassuring the markets:

European stocks are posting solid gains with similar demand building in Dow, S&P and Nasdaq contracts.

This follows chunks of buying interest in Asia-Pacific shares. It looked very much like bargain-motivated flows juiced by a window of benign currency conditions, particularly in Japan, Hong Kong, S. Korea and Australia where benchmarks all added around 1%. Chinese equities also enjoyed a bounce, though to a lesser extent, with precarious sentiment capping Shanghai and Shenzhen gains as investors read the PBoC stepping in as corroborating a sense of crisis. The central bank recommended a reserve ratio requirement cut—essentially looser policy—after fresh tariff threats.

Elsewhere in the markets, cryptocurrency prices are falling after another digital coin exchange was hacked.

The South Korean cryptocurrency exchange Bithumb says it lost 35bn won ($31.5m) worth of virtual coins to hackers. It's the second such breach in a week, highlighting the risks of investing in crypto (as coins are virtually anonymous, they can be almost impossible to recover).

Here's the damage:

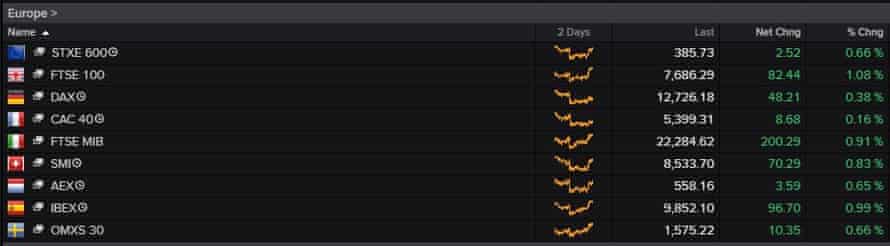

Two hours into the trading day, and European markets are all comfortably higher.

Shares are up across the board, as traders shake off some of their fears about a devastating trade war.

Analysts at FXPro say:

Markets are taking a breath right now and retracing some of the moves over the past number of sessions. Whether this turns into a broader rally or the selloff is resumed remains to be seen. Stock markets are higher after support was found in the European session yesterday and US and Asian traders built on the foundations of that support.

Pound falls ahead of Brexit vote

Sterling has hit a new seven-month low this morning, as the UK government faces another crunch vote over Brexit.

Parliament will vote on the EU withdrawal bill, the government's flagship piece of Brexit legislation, later today. And one group of MPs are refusing to drop their demand for a 'meaningful' vote in the scenario in which Britain can't agree a Brexit deal.

Former attorney general Dominic Grieve insists that parliament must have a chance to protect the UK economy, in the event of a no-deal. Grieve's amendment has been been sent back to the Commons by the House of Lords, amid claims that Theresa May 'double-crossed' Grieve last week by promising to address his concerns, then pulling a u-turn.

The vote could be close, if Grieve's band of backbench Conservative MPs hold firm. Some pro-Brexit Labour MPs could vote with the government, though, which would be a headache for opposition leader Jeremy Corbyn.....

This uncertainty has knocked the pound down by 0.2% to $1.315, the lowest since November 2017.

European markets bounce back

Those calming words from the People's Bank of China are helping markets recover from yesterday's rout.

In London the FTSE 100 has jumped by 80 points, or 1%, to 7683 (partly helped by a weaker pound).

Other European markets are also higher, with Germany up 0.4% and Spain gaining 1% following the rally in Asia overnight.

Mike van Dulken of Accendo Markets reckons investors are "calming their fears about the current US-China trade tariff dispute".

That's partly because neither side has actually imposed tariffs yet -- just made lots of threats.

Elsa Lignos of Royal Bank of Canada explains why things might calm down:

On the trade front, we're likely to see a two month 'hibernation' as the US works through the legal process for the next $200bn of tariffs and China awaits the US' formal response.

Blankfein: US and China will avoid 'suicide pact'

The boss of Wall Street giant Goldman Sachs has predicted that China and the US still step back from a devastating trade wars.

Lloyd Blankfein says that Trump's threat to add tariffs on $200bn of Chinese imports are a negotiating tactic:

That's what you would do if it was a negotiating position, and you wanted to remind your counterparty just how much fire power you had to bring to the negotiation."

Blankfein is hopeful that Washington and Beijing won't mutually destroy their economies.

"I don't think we're in a suicide pact on this..."I suspect we're not going to cause the economies to collapse with Smoot-Hawley on steroids.

The protectionist Smoot–Hawley Tariff Act of 1930 imposed tariffs on more than 20,000 imported goods. It was meant to protect US workers after the Wall Street crash of 1929, but actually appears to have hurt economic growth and didn't prevent the Great Depression.

China's stock market isn't the only one flirting with a bear market.

After days of losses, the Philippines PSI index has fallen almost 20% from its recent peak.

Philippine stocks may fall into a bear market as early as today amid record streak of outflows of 23 straight days. $40 billion in value wiped out this year from the country's biggest stocks pic.twitter.com/eZcFpBGl6j

— David Ingles (@DavidInglesTV) June 20, 2018

China Daily: We must avoid Trump's blood lust

Donald Trump's threat to impose more tariffs on China is dominating the newspapers across Asia today.

The China Daily newspaper – often a good window into Beijing's thinking – has accuse the US of trying to hurt the Chinese economy.

It says:

"Faced with this heightened intimidation from the U.S., China has no choice but to fight back with targeted and direct measures aimed at persuading the U.S. to back off, since it appears that any concessions it makes will not appease the Trump administration, which wants to suck the lifeblood from the Chinese economy."

"Beijing will have to ensure that Washington is aware that there will be heavy price to pay every action it strikes against China if it is to avoid being a victim of the Trump administration's growing blood lust."

The Global Times also put the boot in, saying Donald Trump's administration was the world's biggest destabilising factor.

A raging fever of nationalism rising in the world's sole super power sends an alarming signal. Nationalism is a challenge to globalization. Rising nationalism and protectionism could hinder the process of globalization and jeopardize the world order.

The US often points an accusing finger at alleged economic nationalism of other countries including China, but now, the reality is that Trump's truculent nationalism is posing the biggest threat.

And in Hong Kong, the Apple Daily newspaper produced quite a front page...

The agenda: China calls for calm as trade war fears grow

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Could Donald Trump really trigger a trade war with China? With neither side backing down, the markets getting nervous after yesterday's selloff hit shares and commodities across the globe.

Trump's threat to impose new tariffs on $200bn of Chinese exports has investors worried, with Beijing already vowing to retaliate.

Overnight, China's top central banker urged people to remain strong and calm.

People's Bank of China governor Yi Gang told the Shanghai Securities Journal that China's economy remained solid, and that there was no reason to panic.

"China still has good economic fundamentals and resilient growth. The yuan is one of a few currencies that have appreciated against the US dollar this year.

"I'm fully confident about the health of China's capital market based on the fundamentals."

Yi also pledged that the PBOC would act to "fend off systemic financial risks", and prepare for the danger of "potential external shocks" and "fend off systemic financial risks".

Yi Gang's comments helped to stem another day of losses in China, where shares are on the brink of a bear market (down 20% from their peak).

Shanghai Composite bouncing after a brutal Tuesday; trading close to the bubble burst lows... not a lot going right for #China at the moment.

— Callum Thomas (@Callum_Thomas) June 20, 2018

Obviously this presents downside risks, but one question is where is the pain point for them to launch a new stimulus package? pic.twitter.com/ktTnJbXirg

Shanghai Composite bouncing after a brutal Tuesday; trading close to the bubble burst lows... not a lot going right for #China at the moment.

— Callum Thomas (@Callum_Thomas) June 20, 2018

Obviously this presents downside risks, but one question is where is the pain point for them to launch a new stimulus package? pic.twitter.com/ktTnJbXirg

#China | PBOC Governor Yi Gang says China share price drop on Tuesday were mainly emotions ...nailed it.

— Ioan Smith (@moved_average) June 20, 2018

Other Asian equity markets also recovered a little, with Japan's Topix up 0.5% and Australia's S&P 500 gaining 1.1%.

European traders might also recover their poise today, after Tuesday's selloff.

Fiona Cincotta, senior market analyst at City Index, says investors fear the consequences of a trade war:

Global GDP could stand to be hit by 2% - 3% should the trade war continue and spread, to put this into context the Great Recession wiped out 6% of the global GDP, so this trade spat is by no means insignificant.

For weeks the market has been relatively complacent that Trump's tough protectionist rhetoric were merely a negotiating tool; however, the realisation that the US President is willing to go ahead with his threats has sent a shiver through the markets.

Trump's strategy appears to be to raise the stakes until China is forced to capitulate, by opening up its markets to American goods and addressing intellectual property theft concerns. But if that doesn't happen, the world economy could find itself on a rocky road.

Also coming up today....

Top central bankers are gathered in Sintra, Portugal, for a conference organised by the European Central Bank. Federal Reserve chair Jay Powell, Bank of Japan chief Haruhiko Kuroda, and ECB president Mario Draghi will all speak.

Plue, we get a new healthcheck on Britain's factories and the latest oil inventory figures from America

The agenda:

- From 9am BST: European Central Bank conference in Sintra, Portugal

- 11am BST: CBI industrial trends survey of UK factories

- 3.30pm BST: US weekly oil inventory figures

Source: https://www.theguardian.com/business/live/2018/jun/20/china-trump-trade-war-fears-grow-uk-factories-business-live?page=with:block-5b29feb5e4b0a90d612ab3e5

0 Response to "Funny Korean Boss Gets Nervous When Secretary Flirts"

Enregistrer un commentaire